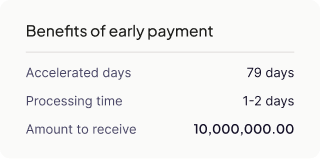

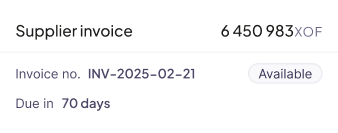

Get paid in 24-48 hours using buyer creditworthiness

How it works

- Submit invoice

- Rapid approval

- Get paid

Discover how our approach compares to conventional credit systems

|

Finco

Faster & better

|

Traditional Banks

|

|

|---|---|---|

Overview |

||

|

Payment Speed

|

24-48 hours

|

30-45 days

|

|

User Experience

|

Digital-first, mobile-optimised

|

Branch-based, paperwork-heavy

|

|

Application Process

|

Clear, streamlined journey

|

Constantly changing requirements

|

|

Collateral Requirements

|

None (leverages buyer credit)

|

Onerous collateral that defeats the purpose

|

|

Documentation

|

Streamlined digital submissions

|

Extensive financial records and statements

|

|

Credit Assessment

|

Data-driven, buyer creditworthiness

|

Traditional models, supplier risk focus

|

Reporting and analytics |

||

|

Interest Rates

|

Competitive (buyer's credit)

|

High (supplier risk premium)

|

|

Transparency

|

Clear pricing upfront

|

Hidden fees and charges

|

|

Accessibility

|

Serves SMEs and informal businesses

|

Upper segment only (10% of population)

|

|

Relationship Model

|

Direct digital engagement

|

Relationship manager dependent

|

We're working on exciting new products, so stay tuned for updates!

Get paid early with automated payroll integration and instant approvals

Affordable car and motorcycle loans with flexible terms and dealer partnerships